Unlocking the Revenue of Apps A Founder's Guide

The revenue from mobile apps is staggering, and it's growing at a pace that's hard to ignore. We're talking about a market projected to blow past $613 billion by 2025. For founders and product leaders, that number isn’t just a headline—it's a massive flashing sign that a killer monetization strategy isn't a "nice-to-have." It's everything.

The Blueprint for Mobile App Revenue

Think of your monetization strategy as the engine in a high-performance race car. You can have the slickest design and the most groundbreaking features, but without a powerful, finely-tuned engine, you're not even leaving the starting line. You're certainly not funding your own growth.

In today's market, a revenue-first mindset is the only way to build a sustainable business on mobile. To really get a feel for what’s possible and set the stage for your own blueprint, it's worth seeing an insider's guide that breaks down how much apps make using different models. It helps connect the dots between big market numbers and what you can actually build.

Why a Revenue-First Mindset Matters

By the end of 2025, that global app revenue figure is expected to land somewhere between $600 billion and $613 billion. This isn't just incremental growth; it's an explosion, driven by gaming, social, entertainment, and a whole new wave of AI-powered apps.

When you slice it by platform, iOS still leads the pack, pulling in around $275 billion compared to Android's $225 billion. The takeaway here is simple: there is a ton of money on the table.

But this growth also means that just building a great product is no longer enough. You have to build a great business, and that starts with knowing the numbers—the key performance indicators (KPIs) that both investors and successful founders live and die by.

Your app's financial health isn't measured in downloads. It's measured by the efficiency of your revenue engine and its ability to turn user engagement into predictable, scalable income.

Introducing Key Monetization Metrics

To steer your app toward profitability, you need a reliable dashboard. These KPIs are your navigation system, telling you if you're on the right track or if it's time to make a sharp turn. Here are the big three you absolutely must know:

- Monthly Recurring Revenue (MRR): For any subscription app, this is your lifeblood. It's the predictable revenue you can count on every single month. Actionable Insight: If your MRR is flat, it's a sign that new revenue is only replacing lost revenue from churn. This tells you to focus on retention features, not just user acquisition.

- Lifetime Value (LTV): This is the holy grail. It’s the total amount of money you expect to make from a single user over their entire time with your app. A high LTV means you're building something people truly value. Actionable Insight: Calculate LTV for different user segments. You might discover that users acquired through a specific marketing channel have a 2x higher LTV, telling you exactly where to double down on your ad spend.

- Average Revenue Per User (ARPU): This metric cuts through the noise. It tells you, on average, how much each active user is worth, giving you a clear picture of your overall monetization health. Actionable Insight: A low ARPU in a gaming app might prompt you to introduce limited-time offers on in-game currency to encourage spending from casual players.

These aren't just abstract terms for a spreadsheet. They're the core components of your revenue blueprint. Getting a solid grip on them is the first real step toward building an app that doesn't just win users, but also delivers a powerful return.

Picking Your App Monetization Engine

Once your financial roadmap is clear, it’s time to choose the engine that will actually power your app’s revenue. This isn't just a small technical choice; it dictates your user experience, sets your growth ceiling, and ultimately determines if you build a profitable business.

Picking the wrong model is like putting a diesel engine in a Formula 1 car. It might move, but it will never perform the way it was designed to.

The four classic monetization models—In-App Purchases, Subscriptions, Advertising, and Paid Downloads—each come with their own set of rules and rewards. Your job is to find the one that fits perfectly with what your app does and how your users behave.

In-App Purchases (IAP): The Impulse Buy Engine

In-app purchases are the undisputed heavyweight champion of mobile monetization. This model lets you sell digital goods or unlock features directly inside your app, capturing value from your most dedicated users without putting up a paywall for everyone else.

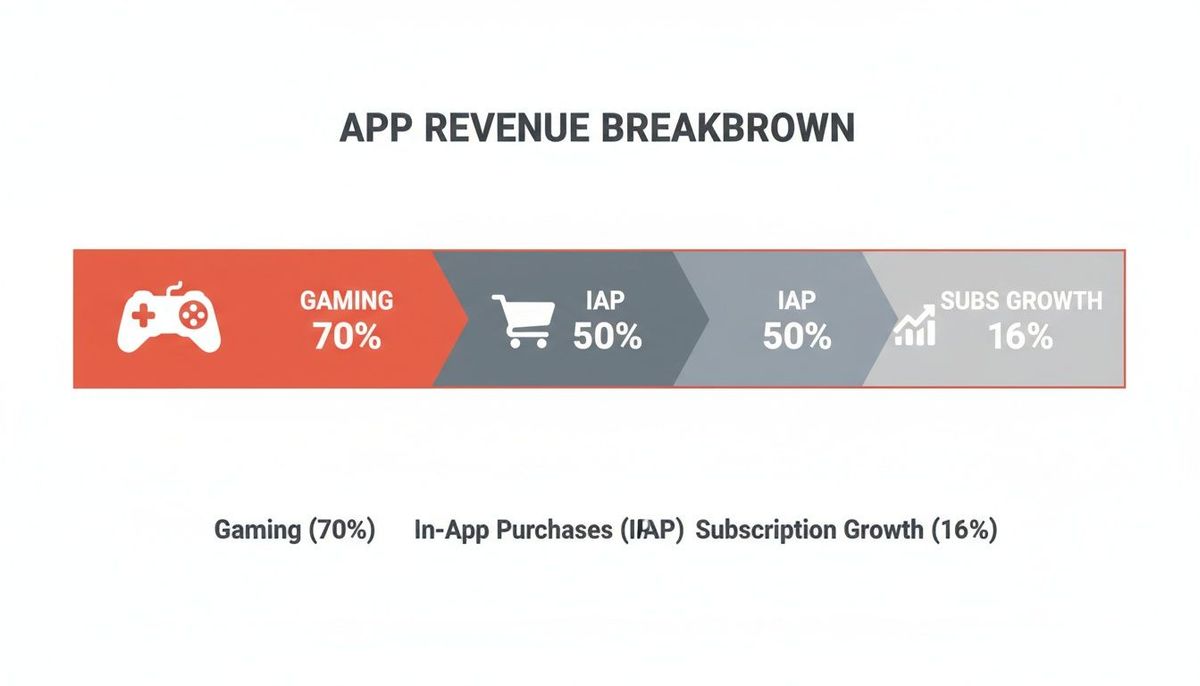

Gaming apps absolutely own this space, pulling in over 70% of all app revenue. By 2025, that number is expected to climb to a staggering $81 billion in consumer spending. Overall, IAPs make up about 50% of all app revenue, making them a beast of a model for any app where users are driven by progress, customization, or just plain convenience.

You've got two main flavors of IAPs to work with:

- Consumables: These are one-and-done items users can buy over and over. Think gems in Clash of Clans or extra lives in Candy Crush. They're designed to fuel repeat engagement from your power users. Practical Example: A language-learning app could sell consumable "streak freezes" that allow users to maintain their daily learning streak even if they miss a day, tapping into the powerful psychological driver of loss aversion.

- Non-Consumables: These are permanent unlocks. Buying the ad-free version, unlocking a premium filter pack, or getting a new set of levels in a puzzle game are all great examples. It’s a single purchase that delivers lasting value. Practical Example: A meditation app can sell a one-time "Anxiety Relief Pack" containing a curated set of meditations. This captures revenue from users who are interested in a specific topic but aren't ready to commit to a full subscription.

A pro move is to blend both. A fitness app could sell a "Pro Features" non-consumable pack while also offering consumable "Nutrition Plan Credits" for generating custom meal plans. This hybrid approach lets you capture both users looking for a long-term upgrade and those who just need a quick boost.

Subscriptions: The Predictable Revenue Engine

Subscriptions have become the new gold standard, especially for apps that deliver ongoing value. Why? Because they generate predictable Monthly Recurring Revenue (MRR), the metric that founders and investors dream about. While IAPs are about a single transaction, subscriptions are about building a relationship.

This model is exploding, growing at a 16.22% compound annual rate for a reason.

By offering ongoing access to content or services, subscriptions transform your app from a product into a utility. It becomes an indispensable part of your user's daily or weekly routine, creating immense stickiness.

Two popular ways to structure subscriptions are:

- Tiered Access: This is the classic model you see in apps like Headspace. A limited set of meditations are free, but the entire library is unlocked with a premium subscription. You create clear value steps (e.g., Basic, Plus, Premium) that encourage users to upgrade as they get more invested. Actionable Insight: Name your tiers based on the user persona, not just features. Instead of "Basic/Pro," try "Learner/Creator." This helps users self-identify with the plan that's right for them, increasing conversion.

- Usage-Based: More common in B2B software but creeping into consumer apps, this model ties the price directly to value. A transcription service might offer a plan with 10 hours of transcription per month, with extra fees for anything over. Users pay for exactly what they use. Actionable Insight: To avoid bill shock, implement smart notifications. A photo-editing app with cloud storage could alert users when they've used 80% of their monthly storage, offering a seamless one-click upgrade to the next tier.

If you're leaning toward subscriptions, our deep-dive on the best app monetization strategies can help you figure out how to structure your tiers for maximum impact.

Advertising: The Volume Engine

The ad-supported model is the most straightforward play: you give your app away for free and make money by showing ads to your massive user base. It’s the path of least resistance for acquiring users, which makes it perfect for hyper-casual games, simple utilities, or any app built for huge volume.

But throwing any old ad at your users can backfire. The format you choose dramatically impacts both your revenue and your user experience. The goal is to make ads a tolerable, or even welcome, part of the experience.

Comparing App Monetization Models

Choosing the right model is a critical decision that shapes your app's entire trajectory. Each of the four primary models—Paid, Ads, IAPs, and Subscriptions—has a different impact on user acquisition, revenue potential, and user experience. To make it clearer, here’s a side-by-side look at how they stack up.

| Model | Best For | Revenue Predictability | User Experience Impact | Example |

|---|---|---|---|---|

| **Paid** | Niche, high-value utility apps with a strong brand. | Low (one-time spike at launch) | High friction (paywall at the start) | Things 3, Procreate |

| **Advertising** | High-volume apps like casual games or content platforms. | Moderate (depends on traffic and ad rates) | Medium to High (can be interruptive) | Flappy Bird, Duolingo (free tier) |

| **In-App Purchases** | Freemium games, content apps with unlockable features. | Low to Moderate (spiky, user-dependent) | Low to Medium (optional purchases) | Clash of Clans, Candy Crush |

| **Subscriptions** | Content, service, or productivity apps with ongoing value. | High (predictable recurring revenue) | Low (value is clear before purchase) | Netflix, Headspace, Strava |

As you can see, there's no single "best" model. The right choice depends entirely on what your app does and the relationship you want to have with your users. Subscriptions offer stability, IAPs capture peak engagement, ads scale with volume, and paid apps target a dedicated niche.

Rewarded video ads are often the best of the bunch. Because users choose to watch them in exchange for a reward (like in-game currency or an extra life), it feels like a fair trade, not an annoying interruption. Practical Example: In a puzzle game, instead of forcing a user to wait 30 minutes for a new "life," offer them the option to watch a 15-second video ad to get a life immediately. This gives the user control and provides instant gratification, making the ad feel helpful rather than intrusive.

Paid Downloads: The Premium Gatekeeper

Finally, there’s the paid download model, the original app store business model. It's simple: users pay a one-time fee upfront to download your app. Done.

This approach only really works for apps with an incredibly clear value proposition and a stellar reputation, usually in niche productivity (like Things 3) or creative professional categories (like Procreate).

The upside is obvious: you get paid for every single download. But the downside is massive. In a world overflowing with free apps, asking someone to pay before they've even tried your product is a huge barrier. It’s no surprise this model now accounts for the smallest slice of the overall revenue of apps market.

What Good App Revenue Benchmarks Look Like

“So… are my numbers any good?”

It’s the question every founder and product manager eventually asks, usually while staring at a dashboard. Without context, your app's revenue data is just that—numbers on a screen. To really get a handle on performance, you have to measure your metrics against industry benchmarks.

This isn't just about vanity. Knowing what’s “normal” helps you set realistic targets, diagnose weaknesses, and find opportunities to get ahead of the competition. But here's the catch: a "good" number for a Health & Fitness app can look completely different from a strong benchmark in a Social or Fintech app. Context is everything.

The infographic below shows where the money is flowing in the app economy. It’s no surprise that gaming and in-app purchases are dominant forces, but the real story is the explosive growth of subscriptions.

This tells us that while different models can work, the real momentum is behind engaging, repeatable purchases and predictable, recurring revenue. That’s a critical insight for strategic planning.

Key Revenue Benchmarks by Category

Let's break down the essential KPIs. Think of these as general guidelines—a solid starting point for grading your app’s financial health and the overall revenue of apps in your space.

- Average Revenue Per User (ARPU): This metric shows how much revenue, on average, each active user brings in over a certain period. For many subscription apps, the median ARPU after 60 days is about $0.31. But for top-tier apps in hot categories like Health & Fitness or AI, that number can easily climb past $0.63.

- Free-to-Paid Conversion Rate: This is your magic number—the percentage of free users who decide your app is worth paying for. A typical conversion rate sits between 1-2%. If you’re pulling in over 3%, you're doing well. And if you hit 5% or more, you're in elite territory.

- Lifetime Value (LTV): This is the ultimate health metric. LTV tells you the total revenue you can expect from a single user over their entire relationship with your app. For a sustainable business, your LTV needs to be at least 3x your Customer Acquisition Cost (CAC). If it's not, you're losing money on growth. Getting this right is non-negotiable, so make sure you understand the complete customer lifetime value calculation formula.

These metrics don’t live in silos; they're all connected. Improve one, and you’ll almost always see a positive ripple effect across the others.

A tiny, 0.5% bump in your free-to-paid conversion rate might not sound like a big deal. But when you apply that to thousands of users, it directly lifts your ARPU, which in turn gives your total LTV a massive boost.

Benchmarking for Subscription-Based Apps

If you're running on a subscription model, then Monthly and Annual Recurring Revenue (MRR and ARR) are your north stars. To set the right expectations for app revenue, you have to understand the nuances of SaaS revenue metrics like ARR vs MRR.

Here are a few specific subscription benchmarks to keep an eye on:

- Monthly Subscriber Retention: After the first month, keeping 50-60% of your subscribers is a good sign. By the third month, if you're still holding onto 35-40%, you’ve built something sticky.

- Annual Subscriber Retention: This is where the real power is. Apps with lower-cost annual plans can retain up to 36% of users after a full year. In contrast, higher-priced monthly plans often only keep around 6.7%. It’s a clear signal of the power of getting that upfront commitment.

- Revenue Growth: The gap between the best and the rest is getting wider. The top 5% of new apps earn over 400 times more revenue than the bottom 25% after just two years. This is proof that the winning apps are the ones that never stop optimizing.

A Practical Example of How These Metrics Work Together

Let’s say you run a fitness app. You have a 1.5% conversion rate and your LTV is $90. Your team rolls out a new onboarding flow that does a much better job of showing off the value of your premium workout plans.

A month later, you check the data. Your conversion rate has climbed to 2.0%. That seemingly small increase doesn't just bump up your immediate revenue. It means more paying users are in your ecosystem, which lifts your ARPU. And because these paid users are more engaged and stick around longer, your average LTV shoots up to $120.

That’s the multiplier effect in action. By zeroing in on a single, strategic lever—conversion—you simultaneously improved both ARPU and LTV, completely changing your app's financial trajectory. This is how the best founders turn good numbers into great ones.

Decoding the iOS vs Android Revenue Gap

It’s one of the oldest truths in the app world, and it catches founders by surprise all the time. While Android absolutely dominates global market share—think sheer volume of downloads—iOS consistently punches above its weight in a metric that matters more: revenue.

Getting your head around this gap isn't just an interesting data point; it's a critical piece of the puzzle for any founder or CTO building a monetization strategy.

We’re not talking about a small difference here. It’s a chasm. The App Store has cultivated a premium ecosystem where users are simply more conditioned to spend money.

This isn’t just a feeling; the numbers back it up. The Average Revenue Per User (ARPU) on iOS is a staggering $138, while on Android, it's just $72. That's almost double. It’s the single biggest reason the App Store drove the majority of the total app earnings in 2022. If you want to dive deeper into the market forecasts, you can explore more detailed industry reports on the mobile application market.

This reality forces a strategic choice right from the start: Do you chase the massive volume on Android or the high value on iOS?

Why iOS Users Spend More

So, what’s really going on here? It boils down to a mix of user demographics, platform design, and deeply ingrained habits.

First, the demographics are different. On average, iOS users have higher disposable incomes. This simple economic fact means they are more willing—and more able—to pay for premium apps, unlock features with in-app purchases, or commit to a subscription that makes their life easier or more entertaining.

Second, Apple has engineered a payment ecosystem that is almost dangerously frictionless.

With a credit card already on file through their Apple ID, making a purchase is a seamless, one-tap action. That low-friction experience removes the exact hesitation points that kill conversions on other platforms.

Strategic Implications for App Development

So how do you actually play this? The answer isn't to just pick one platform and write off the other. A smart, modern approach uses the unique strengths of each to maximize both your reach and your revenue.

For founders and technical leaders, this is where cross-platform frameworks like React Native become a strategic weapon, not just a development shortcut. Here’s a practical way to think about it:

- Build a Single Codebase: You use one framework to build your app for both iOS and Android at the same time. This move alone dramatically cuts your development costs and gets you to market faster than building two separate native apps from scratch.

- Optimize Monetization by Platform: Even with a single codebase, you can still roll out platform-specific monetization strategies. You might push your premium subscription tiers and high-value in-app purchases on iOS, while leaning on an ad-supported model or lower-priced entry points to capture the massive audience on Android. Practical Example: An AI photo-editing app could offer its powerful "Pro" subscription on iOS, while the Android version focuses on driving volume through a free, ad-supported tier with optional, smaller in-app purchases to remove watermarks on a per-photo basis.

- Capture the Best of Both Worlds: This hybrid approach lets you build a flexible revenue engine. You’re not just making an app; you’re building a business that can effectively monetize high-value users on iOS while simultaneously scaling your user base and brand on Android.

Following this playbook means you're not leaving money on the table. You build one product that intelligently adapts its business model, capturing both the high ARPU of the iOS ecosystem and the incredible scale of the Android market.

An Actionable Playbook for Boosting App Revenue

Knowing your benchmarks is step one. Actually improving them is how you win. Turning all that theory into real money requires a hands-on playbook—a set of specific, testable levers your team can pull to directly move the needle on revenue. This isn't about guesswork; it's about systematic optimization.

This playbook cuts through the abstract strategy to give founders and product managers a clear roadmap. We'll break down the core areas where small, intentional changes can lead to huge revenue gains, from simple pricing experiments to building self-sustaining growth engines.

Fine-Tune Your Pricing and Packaging

Your price point is one of the most powerful levers you can pull. Yet, so many teams set it once and just forget about it, leaving a massive amount of cash on the table. The goal is to find that perfect sweet spot between what users are willing to pay and the real value your app delivers.

Systematic A/B testing is how you find it. Don't just test one price against another; test the entire package. Here are a few practical tests you can run right now:

- Tiered Structures: Test a three-tier model (e.g., Basic, Pro, Premium) against a simpler two-tier option. You’d be surprised how often a third "decoy" option makes the middle tier look far more attractive, boosting its conversion rate.

- Annual vs. Monthly Focus: Get creative with how you present your annual plan. Instead of just listing it as an option, try defaulting to the annual plan with a "Most Popular" tag. This anchors users to a higher-commitment, higher-LTV choice. Data consistently shows that apps with lower-cost annual plans can retain up to 36% of users after a year, crushing the 6.7% retention for higher-priced monthly plans.

- Hybrid Monetization: Don't be afraid to mix and match. A growing number of apps—now 35% and climbing—combine subscriptions with one-time purchases. A meditation app could offer its core subscription right alongside a "Lifetime Access" purchase or consumable "Guided Journey" packs. This strategy is brilliant for capturing revenue from users who hate recurring payments but are happy to pay for permanent value.

Optimize the Onboarding Funnel

The first few minutes a user spends in your app are absolutely make-or-break for monetization. A confusing or clunky onboarding flow is where potential subscribers go to die. Your single most important job is to get them to an "aha!" moment before you ever ask for money.

The paywall should never be the first thing a user sees. It should feel like the logical next step after they’ve experienced a real taste of the value you provide.

To get this right, you have to build a value-first onboarding experience. For a fitness app, that means letting a user complete a short workout. For a photo editor, it's letting them apply a premium filter to one of their own photos. Let them feel the benefit before you ask them to pay for it. Actionable Insight: Instead of showing a paywall after signup, trigger it contextually. In a project management app, allow users to create projects freely, but display the paywall when they try to use a premium feature like "add a team member." This links the cost directly to the value they're trying to unlock.

Implement Retention-Driving Features

Acquiring a new user is expensive; keeping an existing one is pure profit. Retention is the silent engine that drives lifetime value and, ultimately, the long-term health of your app's revenue. A few smartly implemented features can dramatically reduce churn.

One of the most effective tools in your arsenal is personalized push notifications. Instead of blasting generic messages to everyone, use behavioral data to send relevant, timely alerts that actually help.

- Usage Triggers: If a user in a language app hasn't completed a lesson in three days, send a friendly nudge with a "quick win" exercise.

- Milestone Celebrations: Congratulate users for hitting streaks or achieving goals. This kind of positive reinforcement builds a real emotional connection to your app.

- Content Updates: Let users know when new content relevant to their interests is available. Give them a compelling reason to come back.

These small, personalized nudges make users feel seen and valued, transforming your app from a simple tool into an active partner in their goals. You can learn more about how to attract and keep these users in our guide on user acquisition for mobile apps.

Build Powerful Growth Loops

The most successful apps don't just throw money at ads to grow; they build growth directly into the product itself. A growth loop is a closed system where the actions of one user directly generate a new user. This creates a self-sustaining cycle that steadily lowers your customer acquisition cost over time.

A classic example is a referral loop:

- Invite: An existing user invites a friend to try the app.

- Reward: Both the user and their friend get a real benefit (like a free month or premium features).

- Activate: The new user signs up, starts using the app, and eventually gets engaged enough to invite their friends. The loop starts all over again.

This isn't just a marketing tactic; it's a core product feature that has to be designed, tested, and optimized just like any other part of your app. Actionable Insight: Dropbox famously built its growth engine by rewarding users with more free storage for referrals. For a modern SaaS app, you could offer early access to beta features or a temporary upgrade to a higher subscription tier as a referral incentive, which costs you nothing but delivers high perceived value.

Mini Case Study: A Fitness App's Revenue Win

Let's put this all together. Picture "FitLife," a hypothetical fitness app struggling with a painfully low 1.5% trial-to-subscription conversion rate. Their onboarding was generic, and their paywall popped up way too early.

Following this playbook, they made two simple but powerful changes:

- Personalized Onboarding: Instead of a generic intro, they added a quick quiz asking users for their primary goal: lose weight, build muscle, or improve endurance.

- Tailored Trial Offer: Based on the user's answer, the trial offer was completely reframed. "Start your 7-day free trial" became "Start your 7-day Muscle-Building Kickstart."

The result? The perceived value of the trial went through the roof. The offer felt personal and directly connected to what the user wanted to achieve. Within a month, their trial-to-subscription conversion rate jumped to 4%. They more than doubled their new MRR without spending a single extra dollar on marketing. That's the power of an actionable, user-centric playbook.

Building and Measuring Your Revenue Stack

A brilliant monetization strategy is just an idea without the right plumbing to make it work. Building a modern, scalable revenue stack is all about picking tools that handle the messy, error-prone parts of making money so you can focus on your actual product.

Think of it like building a house. You need plumbing for water, electrical for power, and a foundation to hold it all together. Your revenue stack has similar specialized layers for managing subscriptions, processing payments, and connecting to the app stores.

Assembling Your Core Revenue Tools

For most apps selling subscriptions or in-app purchases, the technical setup involves three key players. Each has a specific job, and when they work together, they create a solid system for managing the revenue of apps.

- **Payment Processor (e.g., Stripe):** This is your financial engine. It securely handles the actual credit card transactions. Stripe is the go-to for processing payments for things like web-based subscriptions or physical goods sold through your app.

- Store APIs (Apple/Google IAP): These are the non-negotiable gatekeepers. If you're selling digital goods inside your mobile app, you must use Apple’s and Google’s native in-app purchase systems. There's no way around it.

- **Subscription Management (e.g., RevenueCat):** This is the brains of the operation. A tool like RevenueCat sits on top of the store APIs, turning the nightmare of managing subscription states, user entitlements, and cross-platform purchases into a simple, unified process.

Without a management layer, your developers would burn weeks wrestling with different store receipt formats and bizarre edge cases. A tool like RevenueCat abstracts that complexity away, turning what could be a month-long engineering project into a task you can knock out in a weekend.

Building Your Revenue Dashboard

Once the money starts flowing, you need to see what's happening. A good revenue dashboard gives you a real-time pulse on your app's financial health, helping you spot trends and make decisions based on data, not guesses. This should never be an afterthought.

It has to track a few critical KPIs to give you a clear, actionable picture of how the business is doing.

Essential Dashboard KPIs:

- Monthly Recurring Revenue (MRR): The predictable income you get from all your active subscriptions. It's the North Star metric for measuring the scale and momentum of a subscription business.

- Churn Rate: The percentage of subscribers who cancel during a given period. High churn is a massive red flag that you have a problem with your product's value or your ability to keep users engaged.

- Cohort-Based LTV: This tracks the lifetime value of users who all signed up around the same time (e.g., the "January Cohort"). It's the best way to see if product changes are actually improving the value of new users over time.

For instance, if you're watching your churn rate and notice it spikes on day seven of a trial, that's an incredibly useful insight. It tells you to fix your onboarding and show more value before that critical moment, which will directly impact your bottom line. Actionable Insight: Create a dashboard widget that specifically tracks churn by cancellation reason (e.g., "too expensive," "missing features," "technical issues"). This qualitative data is gold, telling you exactly what part of your product or pricing to fix.

Questions We Hear All The Time

After diving into the models, metrics, and tech stacks, founders usually have a few lingering questions about how this all plays out in the real world. Let's tackle some of the most common ones we get.

"How Long Until My App Is Actually Profitable?"

There's no single answer here. Your timeline to profitability is a direct result of your monetization model, how much you spend to get a user (CAC), and the market you're in.

For a subscription app, you might be looking at 6-18 months just to break even on the cost of acquiring a single customer. On the other hand, a viral app monetizing with ads could see positive cash flow much, much faster.

The only thing that really matters is getting your unit economics right. As long as your Lifetime Value (LTV) is higher than your Customer Acquisition Cost (CAC), you have a business that can scale. Profitability is just a matter of time at that point.

Actionable Insight: Focus on shortening your CAC payback period. If your LTV is $100 and your CAC is $50, that's a healthy 2:1 ratio. But if it takes 12 months for a customer to generate $50 in revenue, your cash flow will be strained. By incentivizing annual plans over monthly ones (e.g., offering a "2 months free" discount), you get more cash upfront and can shorten that payback period to just a single transaction, fueling faster, more sustainable growth.

"What’s the Best Way to Make Money with a Social App?"

For consumer social, it’s almost always a phased approach. Your first job is to build an audience—that means a generous free experience is non-negotiable. Forget about revenue until you have a critical mass of people who love your app.

Once you have that engagement, you can carefully layer in monetization without torching your community.

The proven playbook looks something like this:

- In-App Purchases: Start by selling digital goods or currency, like the gifts on TikTok. Example: Allow users to buy "Super Likes" or profile boosts to increase their visibility on a dating app.

- Premium Subscriptions: Offer a "pro" version with advanced features for your power users. Think Discord Nitro. Example: Offer a "Creator" subscription on a social platform that unlocks advanced analytics on their posts and removes watermarks from video exports.

- Smart Advertising: Once your user base is big enough, introduce ads that don't ruin the experience. Example: Integrate native advertising where brands can sponsor content that looks and feels like a regular user post, which is far less intrusive than banner ads.

"Can I Change My Monetization Model After Launch?"

Absolutely. But you have to be smart and transparent about it. Moving from a one-time paid download to a freemium or subscription model is a classic—and often successful—pivot. The trick is not to alienate your earliest supporters.

The standard move is to "grandfather" them in. This means anyone who paid for the app originally gets to keep all the features they paid for, forever, for free. It’s a simple gesture of respect that prevents a community backlash and maintains the trust you worked so hard to build. Actionable Insight: When you make the switch, don't just grandfather old users; give them a bonus. For example, if you move from paid to a subscription with new features, give all your original paid users a free lifetime subscription to the new premium tier. This turns potential complainers into your biggest advocates.

Ready to build an app that’s designed for revenue from day one? At Vermillion, we partner with startups to deliver monetization-ready mobile products fast. Learn how we align our performance with your business outcomes.