Unlock R&D Tax Credit for Software Development and Boost Savings

If you’re a founder pouring capital into a groundbreaking new platform, your biggest line item is probably developer salaries. It’s a necessary expense, but one that drains your runway fast.

Most founders write this off as the cost of doing business. But what if a huge chunk of that spending could be reclaimed?

That’s exactly what the R&D tax credit for software development is designed for. Think of it as the government offering to co-fund your most ambitious technical work. This isn’t some shady loophole; it’s a powerful, intentional incentive meant to keep innovation in the US. Every dollar you spend on eligible engineering can become a source of non-dilutive funding that flows right back into your company.

Turn Your Code into Cash with the R&D Tax Credit

The concept is simple: the government rewards you for creating new or improved software. It’s a dollar-for-dollar reduction in your tax liability. And for early-stage startups, it gets even better—you can often apply it against your payroll taxes for an immediate cash injection.

Why This Matters for Software Companies

The impact here is massive, especially in tech. Software and internet companies already account for nearly 19% of all R&D spending worldwide, so these credits are an absolute game-changer.

In the US, the credit can return between 11.1% and 15.8% of your qualified spending. That means the money you spent prototyping a new app, programming a novel AI model, or re-architecting your platform for scale can come right back to you. We've written a deep dive into R&D tax credits for software development that explains how this can directly benefit your business.

This guide will break down this complex topic into simple, actionable steps. We’ll cover critical concepts like the IRS's Four-Part Test, which is basically the roadmap for figuring out what counts.

For startups, the benefits are crystal clear:

- Slash Your Tax Bill: Directly lower your income tax liability, keeping more cash in the bank.

- Boost Your Cash Flow: Use the credit to offset payroll taxes, freeing up immediate capital.

- Extend Your Runway: Reinvest the cash you get back into hiring, marketing, or more R&D.

To make this even clearer, here’s a quick summary of the key points.

Quick Overview of R&D Tax Credit Benefits for Startups

This table breaks down the essentials of the R&D tax credit, so you can quickly see how it applies to your software startup.

| Benefit/Requirement | Description for Software Startups |

|---|---|

| **Primary Financial Benefit** | A dollar-for-dollar reduction of your income tax liability. For pre-revenue startups, it can offset up to **$500,000** in payroll taxes annually. |

| **What's a "Qualified Expense"?** | Primarily, it's the wages of your US-based engineers (W2 employees) who are directly involved in the R&D work. Supplies and contractor costs can also qualify. |

| **Eligible Activities** | Building new features, developing new algorithms, creating new architecture, prototyping, and evaluating technical alternatives. The key is technical uncertainty. |

| **The "Four-Part Test"** | Your project must aim to create a new or improved product/process, involve a process of experimentation, be technological in nature, and seek to eliminate technical uncertainty. |

| **Documentation is Key** | You can't just claim it; you have to prove it. This means keeping records like Jira tickets, Git commit histories, technical specs, and meeting notes. |

| **Common Misconception** | It's not just for "revolutionary" inventions. Improving an existing product's performance, scalability, or feature set often qualifies. |

This table gives you the high-level view, but the real power comes from understanding how these pieces fit together in a real-world scenario.

A Practical Example

Imagine a fintech startup building a new fraud detection platform. They spend months iterating on a proprietary algorithm that analyzes transaction patterns in real-time. This involves significant technical uncertainty—they have to test multiple machine learning models and database configurations to achieve the required sub-second response time.

The CTO who doesn't know about the R&D credit just sees these costs—hundreds of thousands in salaries—as sunk. The savvy CTO sees that same spending as an investment that will generate a direct financial return, potentially covering the cost of another senior engineer for six months and significantly extending their runway.

Ultimately, claiming the R&D tax credit isn't just a clever tax move. For an innovative software company, it’s a core part of a smart financial strategy.

Passing the Four-Part Test for Your Software Project

To get your hands on the R&D tax credit, your software work has to pass what the IRS calls the “Four-Part Test.” This might sound like some bureaucratic nightmare, but it’s really just a formal way of describing the innovation process your engineering team probably follows every day.

Think of it as a checklist that validates your project’s technical ambition. Each test helps prove you're pushing boundaries, not just performing routine maintenance or cosmetic updates. Let's break down each part and see how it maps to real-world software development.

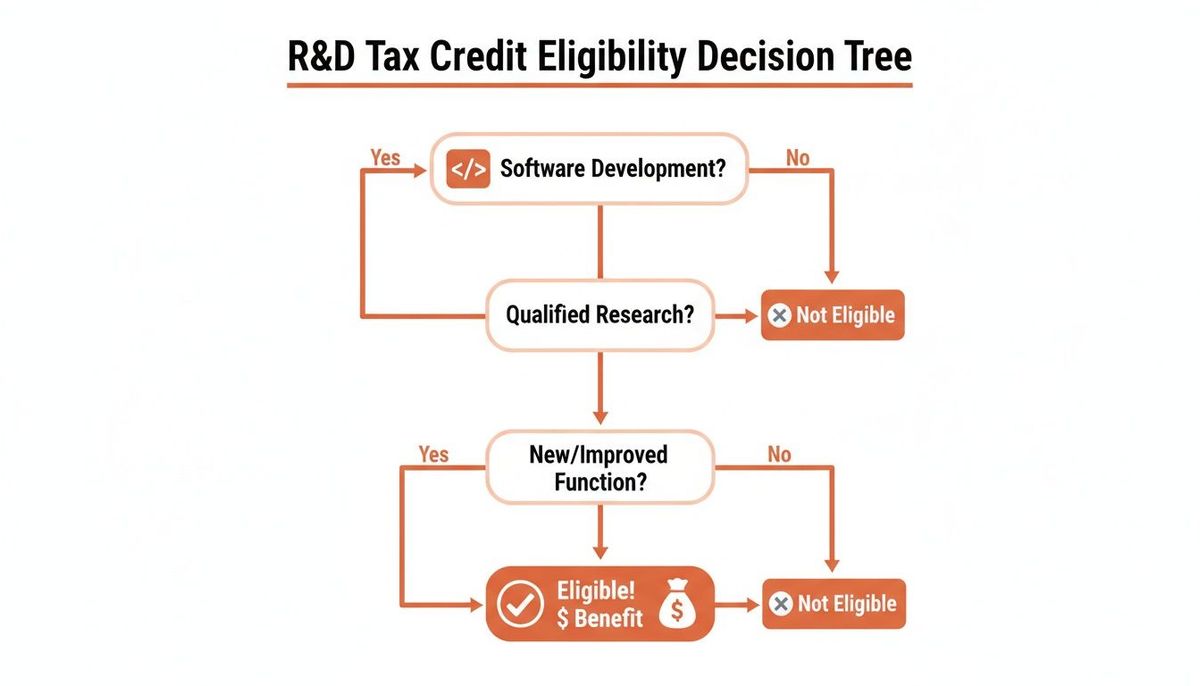

This decision tree gives you a quick visual of the path from standard software work to activity that qualifies for a serious financial benefit.

As you can see, the game is all about moving beyond the routine. The moment your work involves technical uncertainty and experimentation, you're in the right territory for the credit.

The Permitted Purpose Test

First, your research must aim to create a new or improved business component. In our world, a "business component" is simply a product, process, software, technique, formula, or invention that you either sell to customers or use to run your own business.

Honestly, this is the easiest test to pass. If you're working to boost functionality, performance, reliability, quality, or scalability, you've got this one covered.

- Actionable Insight: Your team is re-architecting your backend to reduce API response time from 800ms to under 200ms. The goal is to improve performance and user satisfaction. This effort to create an improved, more performant software component easily passes the permitted purpose test.

The Elimination of Uncertainty Test

This one is the absolute heart of a strong R&D tax credit claim. You have to show that when the project started, you faced technical uncertainty about the right way to build it. You weren't sure about the capability, the method, or the best design for the component.

This isn’t about market uncertainty like, "Will customers buy this?" It's about technical uncertainty: "Can we even build this to perform the way we need it to?" If the answer wasn't obvious or sitting in a Stack Overflow post, you're on the right track.

Key Insight: The IRS wants to see that your team couldn't just look up the answer in a textbook. They had to figure it out because no clear path forward existed at the start.

- Actionable Insight: A health-tech company is building a new feature to process and analyze large medical imaging files. At the project's outset, the team is genuinely unsure if their current cloud architecture can handle the terabytes of data or which image processing library will deliver the required diagnostic accuracy without timing out. This is a perfect example of technical uncertainty.

The Process of Experimentation Test

To crush that uncertainty, you must go through a process of experimentation. This just means you had to evaluate one or more alternatives to figure out the best path forward. This is what modern software development is all about.

This process includes activities your team does all the time:

- Developing and testing different hypotheses ("Will using a GraphQL API reduce our data load?")

- Running systematic trials and analyzing the outcomes.

- Comparing different algorithms, architectures, or development methods.

- Building prototypes, proofs-of-concept, or running simulations.

Essentially, you applied the scientific method to your code. You iterated, tested, and refined your approach based on what the data and performance metrics told you, rather than just following a pre-written blueprint.

- Actionable Insight: To solve their image processing challenge, the engineering team builds three different prototypes. One uses a custom Python script, another leverages a third-party SDK, and a third offloads the work to a specialized cloud service. They run benchmark tests on each, comparing processing speed, cost, and accuracy. This systematic evaluation of alternatives is a crystal-clear process of experimentation.

The Technological in Nature Test

Finally, your process of experimentation must be technological in nature. This means your work has to lean on the principles of the "hard sciences"—think engineering, physics, chemistry, or, for our purposes, computer science.

For any software project, this test is almost a given. The very act of writing source code, designing software architecture, creating algorithms, and applying principles of data structures is, by definition, technological. You're using the fundamental rules of computer science to build something new.

Put all four tests together, and you'll quickly realize that many of your team's daily sprints, technical spikes, and architectural debates fit perfectly within the IRS's definition of qualified R&D.

Calculating Your Qualified Research Expenses

Once you’ve confirmed your project passes the Four-Part Test, the next step is turning all that hard work into actual cash savings. This is where Qualified Research Expenses (QREs) come into play. Think of QREs as the specific, IRS-approved costs that form the foundation of your tax credit claim.

It's not as complicated as it sounds. The IRS essentially groups these costs into three main buckets, which makes tracking what counts much easier. Let’s break down each one with real-world examples you’d see in any software company.

Employee Wages for Qualified Services

For nearly every software company, this is the big one—the largest and most important QRE category by a long shot. This bucket includes the taxable wages you pay your W-2 employees for performing, directly supervising, or directly supporting qualified research.

A common pitfall is to just claim 100% of an engineer's salary without any proof. The key is to allocate wages based on the actual time they spent on qualifying work. You have to be able to back it up.

Practical Example: Your lead engineer earns an annual salary of $180,000. Based on Jira tickets tagged "R&D," you can show she spent 80% of her time over the last quarter developing a new, experimental AI-powered search algorithm (a qualifying activity). The other 20% went to routine bug fixes and customer support (non-qualifying). You can include $144,000 ($180,000 x 80%) of her salary as a QRE for the year.

Supplies Used in R&D Activities

The "supplies" category covers tangible property used or consumed during the R&D process. For software companies, this has a very specific and crucial application: your cloud computing costs.

Expenses for cloud services like Amazon Web Services (AWS), Google Cloud Platform (GCP), or Microsoft Azure can qualify if they are used directly for development, prototyping, and testing. Production server costs don't count, but the infrastructure supporting your R&D does.

- Hosting Development Environments: The AWS EC2 instances your developers use to write and test new code.

- Running Prototypes: The GCP bill for spinning up a Kubernetes cluster to run a proof-of-concept for a new microservice.

- Automated Testing: The cost of the CI/CD pipeline servers (e.g., Jenkins on Azure) that run tests on new, experimental builds.

Contract Research Expenses

Many startups bring in external help to augment their in-house teams, whether it's a freelance specialist or a full development agency. A good portion of these costs can be included in your R&D tax credit claim, but there's a specific rule you need to know.

You can typically include 65% of the amount paid to US-based contractors for their qualified research services. The key here is "US-based"—work performed outside the United States doesn't qualify.

Practical Example: You hire a US-based freelance machine learning expert for $50,000 to help build a prototype of your new algorithm. You can include $32,500 ($50,000 x 65%) as a qualified contract research expense. If you're trying to figure out what these costs might look like ahead of time, our app development cost calculator can give you a solid baseline.

To make it even clearer, here’s a quick rundown of what typically qualifies and what doesn’t when you’re building software.

Eligible vs. Ineligible Software Development Costs

| Expense Category | Eligible (Qualifying Research Expense) | Ineligible |

|---|---|---|

| **Employee Wages** | Salaries of W-2 engineers, project managers, and QA testers actively working on new features. | Salaries for marketing, sales, administrative staff, or maintenance activities. |

| **Cloud Computing** | AWS/GCP/Azure costs for development, staging, and testing environments. | Server costs for hosting the live, customer-facing production application. |

| **Contractors** | **65%** of payments to a US-based firm hired to build a new experimental module. | Payments to overseas developers or agencies. |

| **Supplies** | Physical materials purchased for building and testing a hardware prototype. | General office supplies, rent, utilities, or travel expenses. |

| **Legal & Patent** | Costs for attorneys to file a patent for a new, innovative process. | Costs for trademark registration or general corporate legal work. |

This table should give you a good mental checklist as you review your expenses. The goal is to maximize your claim by including everything you're entitled to while staying squarely within the IRS guidelines.

Choosing Your Calculation Method

Once you've added up all your QREs for the year, you have to choose a method to calculate the actual credit amount. There are two main paths.

- The Regular Credit Method: Honestly, this one is pretty complex. It requires a lot of historical data on your QREs and gross receipts, involves calculating a "base amount," and is generally a headache for newer companies that don't have years of records to pull from.

- The Alternative Simplified Credit (ASC): This is the go-to for most software companies, and for good reason. It's far more straightforward. The ASC lets you claim a credit equal to 14% of the QREs that are over 50% of your average QREs from the previous three years. Even better, for startups with no R&D history, the credit is a flat 6% of the current year's QREs.

The ASC method takes a lot of the historical number-crunching out of the equation, making the r&d tax credit for software development much more accessible for startups and growing tech companies.

The Payroll Tax Credit: Turning Your R&D into Immediate Cash

For most early-stage startups, especially those still in the pre-revenue phase, a standard income tax credit doesn't do much good. You can't reduce a tax bill you don't have yet. This is where the R&D tax credit gets really powerful for new companies: the payroll tax credit offset.

It’s a game-changer. This provision lets qualifying startups turn a future tax benefit into cash savings right now. It's designed specifically for companies that are spending heavily on engineering but haven't started generating revenue.

Who Qualifies for the Payroll Tax Credit?

The rules are pretty clear and laser-focused on young, innovative companies. Your startup needs to hit two specific criteria:

- Less than $5 million in gross receipts for the tax year you're claiming the credit.

- No gross receipts for any tax year before the last five years. In simple terms, your company is less than five years old.

If you check both of those boxes, you can choose to apply your R&D credit directly against your payroll taxes. This shifts the r&d tax credit for software development from a deferred asset you might use years down the road into an immediate boost to your cash flow.

The payroll tax credit lets qualified startups claim up to $500,000 a year to offset the employer's share of Social Security taxes. It directly cuts your quarterly payroll tax bill, freeing up cash you can put right back into the business.

This kind of immediate capital is more critical than ever. The global market for R&D Tax Credit Software is on track to hit $2,450 million by the end of 2025—a huge signal that companies are getting serious about finding every possible dollar. It's a clear sign that founders are actively hunting for these financial lifelines.

A Practical Example: How It Impacts Your Runway

Let's break down how this works for a typical seed-stage SaaS company. Imagine they're two years old, pre-revenue, and have calculated $400,000 in Qualified Research Expenses (QREs) for the year. This came from the salaries of three US-based engineers and their AWS development server costs.

- Calculate the R&D Credit: They use the Alternative Simplified Credit (ASC) method. Since they have no prior R&D history, their credit is 6% of their QREs. That gives them a $24,000 federal R&D credit ($400,000 x 0.06).

- Elect the Payroll Tax Offset: They have no income tax liability, so this is a no-brainer. They file Form 6765 with their annual tax return and check the box to elect the payroll tax offset.

- Slash Quarterly Tax Bills: In the first quarter after filing their return, they also file Form 8974 with their quarterly payroll tax return (Form 941). The $24,000 credit immediately begins reducing their employer Social Security tax liability.

- Reclaim Cash: Instead of paying their full payroll tax bill, they pay a reduced amount until the entire $24,000 is used up. This puts real cash back in their bank account each quarter.

Suddenly, that $24,000 is cash back in the bank. That could cover a junior developer's salary for a few months, pay for a critical user acquisition campaign, or just give them a bit more breathing room on their runway. When you understand how to use your development budget efficiently, that reclaimed capital can be the fuel that gets your product to the next stage.

Building an Audit-Proof Documentation Strategy

A winning R&D tax credit claim isn’t something you throw together at tax time. It’s built month by month, sprint by sprint. The difference between a smooth claim and a nightmarish audit comes down to one thing: solid, contemporaneous documentation.

That’s just a fancy way of saying “proof created as the work happens,” not six months later when everyone’s memory is fuzzy. The good news? You don’t need to create a bureaucratic mess. The secret is to weave documentation right into the development workflow you’re already using.

The IRS wants to understand the why behind your technical choices. Why did your team pick one database over another? What specific technical roadblocks did you hit building that new API, and how did you experiment your way out of it? Answering these questions with real-time evidence is the bedrock of an audit-proof strategy.

Weave R&D Proof into Your Daily Workflow

The best evidence you have is probably already sitting in the tools your team uses every single day. The goal isn’t to add a bunch of new, painful processes. It's about slightly tweaking your existing habits to capture the story of your innovation as it unfolds. This is infinitely more effective than trying to piece together a story from memory a year down the road.

Think of your project management tools as your lab notebook. Every ticket, commit, and pull request can tell a piece of the story.

Actionable Insight: An auditor should be able to look at your Jira board and a developer's commit history and clearly follow the narrative: "We faced uncertainty about scaling our user database (the problem). We evaluated CockroachDB and a sharded PostgreSQL setup (the experiment). The benchmarks in this report show why we chose CockroachDB (the resolution)."

This approach doesn’t just support your claim for the r&d tax credit for software development; it creates an incredible internal record of your team's wins and lessons learned, making every future claim that much easier to build.

Actionable Documentation Tactics for Your Dev Team

Here are a few practical, low-friction ways to capture the details you need without derailing your team’s momentum. These tactics are designed to fit right into the reality of modern software development.

- Tag R&D Work in Jira (or Asana, or Linear). This is the easiest win. Create a specific tag or issue type like "R&D-Eligible" or "Technical-Uncertainty." When a developer tackles a task to evaluate a new algorithm or build a proof-of-concept for a more scalable architecture, they just add the tag. Boom—you now have an easily filterable record of all qualifying work.

- Write Better Git Commits. Encourage your team to level up from "bug fix" or "updated feature." A great R&D commit message paints a picture. Something like: "Experimenting with Redis for session caching to solve latency issues under high load. Initial tests show a 30% performance improvement over the previous database query method." This one sentence connects the work directly to a technical uncertainty and its experimental fix.

- Archive Your Brainstorms. Don’t throw away the slide decks, whiteboard photos, or Miro boards from your architectural reviews and sprint planning sessions. These artifacts are absolute goldmines of evidence, showing the different paths your team considered and the technical reasons you chose the one you did.

Formalizing this process is key. Understanding how to create Standard Operating Procedures (SOPs) can help you build simple, repeatable guidelines that ensure your team consistently captures the right information without adding friction.

Connect the People to the Projects

The final piece of the puzzle is linking the people to the work. It isn't enough to show what was done; you have to prove who did it and for how long. This is how you tie your biggest expense—wages—directly to your qualifying activities.

This doesn't mean you need to install intrusive, minute-by-minute time-tracking software. You can get there with much simpler methods:

- Run Quick Allocation Surveys. At the end of each sprint or month, have your tech leads or project managers estimate the percentage of time each developer spent on tagged R&D tasks versus non-qualifying stuff like routine bug fixes or customer support.

- Use Project Data for Estimates. The data in your project management tools can do the heavy lifting. If a developer's plate for a sprint was 75% R&D-tagged tickets, you have a very credible basis for allocating 75% of their wages for that period to your QREs.

By putting these small but consistent habits in place, you build a powerful, audit-proof case for your claim. This isn't just theory; it’s a core part of how modern dev teams are successfully claiming the r&d tax credit for software development and turning their engineering costs into valuable capital.

If you want to dive deeper into structuring your team for this kind of efficiency, check out our guide on implementing agile DevOps for enterprises.

Exploring State and Global R&D Incentives

The federal R&D tax credit is a huge win, but it’s just the first layer. Many states have their own R&D incentives, and this is where things get really interesting. You can often "stack" these credits, which can seriously amplify your savings—think of it as a bonus for keeping your innovation local.

But here’s the thing: these state-level programs aren’t just a copy-paste of the federal rules. Each state has its own playbook with different rules, calculation methods, and eligibility criteria. Getting a handle on these differences is the key to maximizing your claim for the R&D tax credit for software development.

How State R&D Credits Differ

State programs almost always diverge from the federal guidelines in a few critical ways. Some offer refundable credits, which means you get a check in the hand even if you don't owe any state tax. Others might define qualifying expenses differently or insist that the research physically happens within state lines to count.

Just look at two of the biggest tech hubs, California and Texas. They show this contrast perfectly:

- California: Often seen as one of the most generous states, California's credit calculation is a huge advantage for companies with growing R&D budgets. The catch? The work has to be done in California. There are also other programs to look into, like the California Competes Tax Credit and Grant Program, which offers another major opportunity for businesses in the state.

- Texas: The R&D credit in Texas is applied against the state’s franchise tax. But a recent change now lets businesses claim a credit against their sales and use tax, giving different types of companies much more flexibility.

A Look at the Global Landscape

This isn't just a U.S. phenomenon. Countries all over the world are dangling similar R&D carrots to attract top-tier tech talent and convince companies to set up shop. Nations like Canada and the United Kingdom have incredibly robust, long-standing programs that are highly competitive with what the U.S. offers.

This global competition is only heating up. Governments are supercharging their R&D tax credit programs, and the market for services that help companies claim them is projected to hit $8,769.2 million by 2033. Just look at the impact: in Ireland, €1.16 billion in credits unlocked €4.6 billion in R&D spending, and 47% of the companies that participated added new jobs.

Meanwhile, back in the states, Texas's Senate Bill 2206 is set to boost state credits starting in 2026, while New York now requires companies to create at least five net new jobs to qualify. For a deeper dive on these trends, you can check out the full market research on Archive Market Research.

Actionable Insight: If you have a development team split between Austin and Toronto, you need a dual strategy. You would claim the wages for your Austin team under both federal and Texas state R&D programs. Simultaneously, you would engage with Canada's SR&ED program for the Toronto-based developers, which has entirely different rules but offers some of the most generous refundable credits in the world. This multi-layered approach maximizes your global return on R&D investment.

Common Questions About the R&D Tax Credit

Moving from the theory of R&D tax credits to the practical application always brings up some tricky questions. When you're trying to figure out what counts, you're really drawing a line in the sand between everyday work and genuine innovation. Let's clear up some of the most common gray areas.

Lots of founders ask about the small stuff—bug fixes, minor tweaks, routine upkeep. It's a critical distinction that can make or break your claim.

Does Bug Fixing or Routine Maintenance Qualify?

Generally, no. Things like standard maintenance, QA testing on existing features, or zapping minor bugs don't clear the high bar of "technical uncertainty" the credit requires. The IRS sees these tasks as the normal cost of doing business.

But there's an important exception. Imagine a bug is causing a critical memory leak that crashes your application under heavy load. If your team must evaluate multiple caching strategies, memory profiling tools, and potential architectural changes to diagnose and resolve the root cause, that investigative process could qualify. The focus shifts from a simple patch to a systematic experiment to solve a fundamental technical problem.

Can We Claim the Credit if Our Project Fails?

Absolutely. This is one of the most powerful—and most misunderstood—parts of the R&D tax credit. The whole point of the incentive is to reward the process of research and experimentation, not just the projects that hit commercial home runs.

Practical Example: You spend three months and $100k in engineering salaries trying to build a novel video compression algorithm, but ultimately can't get it to work performantly and abandon the project. As long as you documented your process of experimentation (the different approaches you tested), those $100k in wages are still eligible for the credit. The government wants to encourage you to take big technical swings, and they know that failure is just part of the game.

Do UI and UX Design Activities Qualify?

This is a classic "it depends." Standard UI/UX work—making things look prettier, applying well-known design patterns, or minor cosmetic updates—usually won't qualify. Why? Because there’s no real technological uncertainty involved.

Actionable Insight: The credit kicks in when design work pushes technical limits. For example, if your team is developing a novel gesture-based interface for an augmented reality application, the work to create new interaction models and solve the associated software challenges would likely qualify. However, choosing a new color palette for your website's CSS would not.

What Is the Deadline for Claiming the Credit?

The most straightforward way to claim the R&D tax credit is by filing Form 6765 along with your company's annual federal income tax return. To get the maximum benefit with the least hassle, you should always aim to claim it with your timely filed return for the year the expenses happened.

But if you didn't, you haven't necessarily lost your chance. You can go back and amend a prior-year return to claim the credit. You generally have up to three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.

Maximizing your R&D tax credit starts with expert execution and meticulous documentation from day one. At Vermillion, we build revenue-ready mobile apps while producing the technical documentation you need, reducing your effective development cost by 20-40%. Learn how our performance-based model aligns with your startup's success.