Customer Acquisition Cost vs Lifetime Value Unlocking Sustainable Growth

Let’s get one thing straight: the difference between CAC and LTV is pretty simple. CAC measures what you spend to get a customer. LTV measures what you earn from them over time.

One is your investment, the other is the return on that investment. Get that relationship wrong, and you don't have a business—you have a leaky bucket. A sustainable company absolutely has to make more from customers than it costs to bring them in the door.

Defining the Core Metrics of Business Health

Understanding Customer Acquisition Cost (CAC) and Lifetime Value (LTV) isn't just a marketing task. It’s the financial bedrock of a scalable business. When you look at these two metrics together, they give you a brutally honest verdict on the health of your growth engine. They answer the only question that really matters: is this business model actually profitable in the long run?

- Customer Acquisition Cost (CAC) is the total cash you burn to turn a prospect into a paying customer. It’s a direct measure of your sales and marketing efficiency.

- Lifetime Value (LTV) is the total revenue you can reasonably expect from a single customer over their entire relationship with your company. It’s a measure of value and loyalty.

A low CAC looks great on a spreadsheet, but it’s totally meaningless if those "cheap" customers churn after one month. On the flip side, a high LTV is fantastic, but not if it costs you more to acquire those customers than they're ultimately worth. The real magic happens when you look at them together—the LTV to CAC ratio.

The LTV to CAC ratio is the ultimate gut check for a sustainable business. It tells you whether you're creating or destroying value with every new customer you sign up.

The Investor's Viewpoint

Investors and savvy founders fixate on this ratio because it cuts through vanity metrics like user growth or top-line revenue and gets straight to profitability. For more than a decade, the LTV:CAC ratio has been the gold standard for growth-focused companies.

The benchmark you'll hear over and over is 3:1—for every $1 you spend acquiring a customer, you should generate $3 in lifetime value. Companies that consistently hit this mark or better often trade at a premium. Those struggling below 1:1 are literally destroying value, even if revenue looks healthy on the surface.

To really nail this down, it helps to dig into the individual metrics. You can find deep dives on topics like what Customer Lifetime Value (LTV) is that break it down even further.

For a quick reference, here's how the two metrics stack up.

CAC vs LTV At a Glance

The table below offers a quick comparison, breaking down what each metric measures, how it's calculated, and where it fits into your broader strategy.

| Metric | What It Measures | Basic Formula | Strategic Focus |

|---|---|---|---|

| **CAC** | The total cost to acquire a single new customer. | Total Sales & Marketing Spend / Number of New Customers Acquired | Efficiency & Optimization |

| **LTV** | The total revenue a customer will generate over their lifetime. | Average Revenue Per User (ARPU) x Customer Lifetime | Retention & Monetization |

Think of CAC as your short-term tactical focus—how efficiently can you get people in the door? In contrast, LTV is your long-term strategic focus—how good are you at keeping them and maximizing their value? You need both to win.

How to Calculate LTV and CAC with Accuracy

Theory is great, but the real wins happen when you move from concept to calculation. Getting Customer Acquisition Cost (CAC) and Lifetime Value (LTV) right is absolutely essential for making smart decisions. A small error can make you think a failing marketing channel is a goldmine, or that your business model is solid when it’s actually bleeding cash.

To get a true read on your financial health, you need to ditch the surface-level formulas. It's time to dig deeper. Let’s break down how to calculate a fully-loaded CAC and a predictive LTV with the precision your business demands.

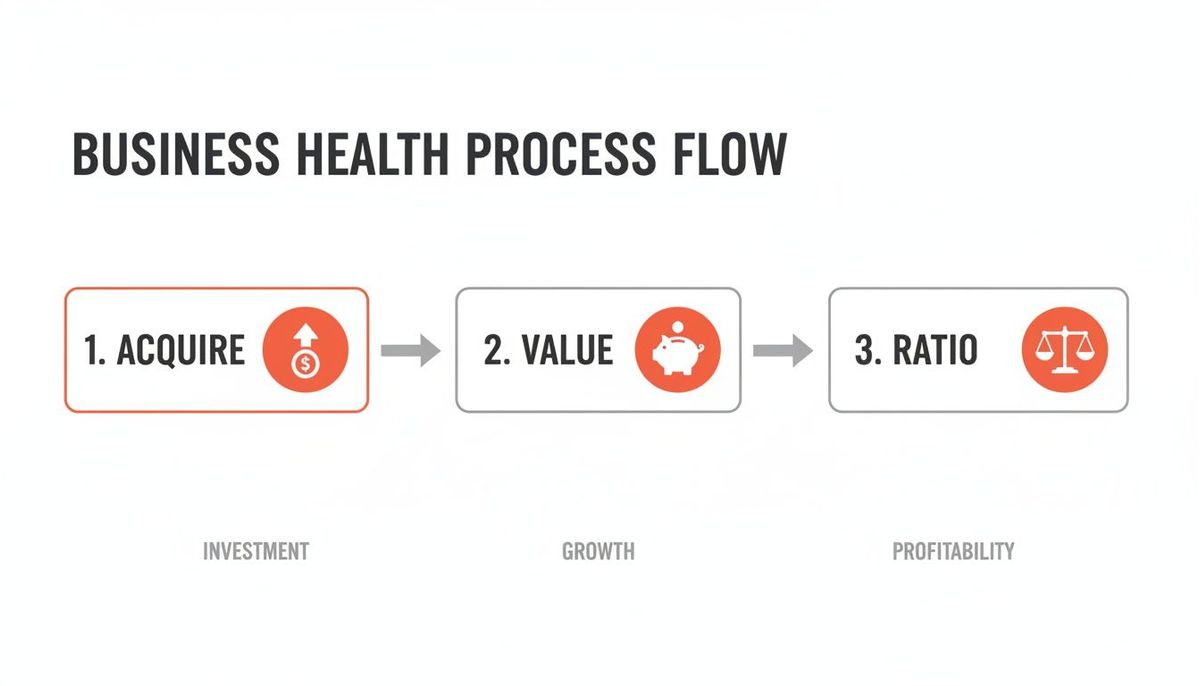

The process is simpler than you think. You invest in acquiring customers, they generate value over time, and the ratio between the two determines your profitability.

This flow is the heart of the LTV to CAC analysis. It's all about ensuring your initial spend translates into long-term value.

Calculating a Fully-Loaded Customer Acquisition Cost

One of the biggest mistakes I see is businesses underestimating their CAC. It's easy to just count direct ad spend and call it a day, but that ignores a ton of other expenses that went into winning that customer. A "fully-loaded" CAC gives you a much more honest—and actionable—number.

The formula itself is straightforward:

CAC = Total Sales & Marketing Costs / Number of New Customers Acquired

The magic is in what you include in "Total Sales & Marketing Costs." To get this right, you have to add up every single relevant expense over a set period, like a month or a quarter.

- Salaries: The portion of salaries for your entire sales and marketing team.

- Advertising Spend: Every dollar spent on paid channels—Google Ads, social media campaigns, sponsorships, you name it.

- Tool Subscriptions: The cost of your CRM, marketing automation platforms, analytics software, and SEO tools.

- Overhead: A proportional slice of office rent and utilities that your sales and marketing departments use.

- Content & Creative: Expenses for freelance writers, designers, video production, or any other creative assets.

Practical Example: SaaS Company Imagine a SaaS business spends $30,000 on ads, $40,000 on team salaries, and $5,000 on software tools in one quarter. During that time, they bring in 500 new customers. Total Costs = $30,000 + $40,000 + $5,000 = $75,000 CAC = $75,000 / 500 = $150 per customer Actionable Insight: With this number, the company can now evaluate its pricing tiers. If their basic plan is only $25/month, they need a customer to stick around for at least 6 months just to break even on acquisition costs, not even counting other operational expenses. This might signal a need to focus on acquiring customers for higher-tier plans.

This fully-loaded approach prevents nasty surprises and gives you a true benchmark for how your channels are performing. Facing these financial realities is a critical part of using data-driven insights to steer your growth.

Calculating a Predictive Lifetime Value

A simple LTV formula is a good start, but a predictive model that accounts for churn and margins gives you a far more realistic picture of future revenue. The basic formula most people use is Average Revenue Per User (ARPU) x Customer Lifetime.

But we can do better. A much more robust formula is:

LTV = (ARPU x Gross Margin %) / Customer Churn Rate

This model is superior because it directly factors in profitability (Gross Margin) and customer loyalty (Churn Rate)—the two real drivers of long-term value.

Practical Example: D2C eCommerce Brand A direct-to-consumer brand sees its average customer spend $80 per month (ARPU). Their gross margin is 60%, and their monthly customer churn rate is 5%. LTV = ($80 x 0.60) / 0.05 = $960 Actionable Insight: Knowing their average customer is worth $960 in gross profit allows the brand to confidently set its marketing budget. They can now decide if paying a CAC of $200, $300, or even $400 makes financial sense to acquire a new customer, ensuring their campaigns are profitable in the long run.

This calculation tells us that, on average, each new customer is expected to generate $960 in gross profit over their entire relationship with the brand. This is the number you need to compare against your CAC.

This focus on retention-driven value isn't just a "nice-to-have" anymore. Customer acquisition costs have shot up by nearly 60% in the last decade, mostly due to fierce competition for ad space. Research shows that a 1% gain in retention can boost company value by up to 6.75%. In contrast, a 1% reduction in CAC adds only 0.32% at best. The winner is clear: retention is the new growth.

What Your LTV to CAC Ratio Is Trying to Tell You

Running the numbers on LTV and CAC is just the first step. The real magic happens when you interpret the ratio they create. This single number acts as a powerful diagnostic tool for your business, giving you a brutally honest signal about your company's health and potential. It tells you whether your growth engine is efficient, just burning cash, or leaving a massive opportunity on the table.

Understanding the story behind your LTV to CAC ratio is what separates founders who build sustainable businesses from those who just chase vanity metrics. It's the context you need to allocate budgets, kill underperforming channels, and steer your company toward real profitability.

What Is a Good LTV to CAC Ratio?

The most widely accepted benchmark for a healthy, scalable business is a ratio of 3:1. In simple terms, this means for every dollar you burn to acquire a customer, you get three dollars back over their lifetime. A 3:1 ratio tells you your marketing is working and your business has enough of a financial cushion to cover all your other costs—salaries, servers, office snacks—and still turn a solid profit.

Hitting this 3:1 mark is a powerful signal to investors and stakeholders. It screams that you’ve found a scalable, profitable growth model, suggesting you have strong product-market fit and a go-to-market strategy that actually works.

But "good" isn't a universal constant. The ideal ratio shifts depending on your industry, business model, and how fast you're trying to grow.

- For SaaS Businesses: A 3:1 ratio is the gold standard. But if you're hitting 4:1 or 5:1, you're in an even stronger position, likely driven by fantastic retention and smart monetization.

- For eCommerce Brands: Anything above 3:1 is solid. Given the lower margins and cutthroat competition in e-commerce, a 4:1 ratio signals exceptional performance and serious brand loyalty.

Think of these benchmarks as your North Star for evaluating performance.

Decoding Different Ratio Scenarios

Your specific ratio tells a unique story. A number below 3:1 isn’t always a catastrophe, and a number way above it isn't automatically a victory. Each scenario demands a completely different strategic response.

A ratio of 1:1 means you're losing money on every single new customer once you factor in the cost of goods sold (COGS) and operational overhead. This is a five-alarm fire. Your business model is fundamentally broken and needs immediate, drastic attention.

Let's break down what different ratios are telling you and what you should do about them.

1. The Danger Zone (Below 1:1)

If your LTV to CAC ratio is less than one, you are actively destroying value. Your business is a leaky bucket, and pouring more money into marketing will only sink you faster.

- Diagnosis: Your acquisition channels are wildly inefficient, your pricing is way too low, or your product is hemorrhaging users.

- Actionable Insight: Immediately kill or slash spending on your most expensive acquisition channels. Stop everything else. Your only priority is to diagnose the root cause—it's almost always a catastrophic churn problem or a broken monetization strategy. For example, if your Google Ads spend is $50k/month with a CAC of $300 and your LTV is only $250, turn off the campaign today.

2. The Break-Even Slog (1:1 to 2:1)

A ratio in this range means you're barely breaking even or making a razor-thin profit on each new customer. You aren't losing money directly on acquisition, but you almost certainly don't have enough margin left to cover salaries, R&D, and other overhead.

- Diagnosis: Your business model is fragile. You might have found a marketing channel that works, but your unit economics are too weak to scale aggressively.

- Actionable Insight: This is optimization time. You need to focus on improving conversion rates to lower your CAC and implementing retention strategies to boost LTV. For instance, if your data shows users who complete your onboarding tutorial have a 20% higher LTV, your immediate goal should be to drive every new user through that flow.

3. The Growth Signal (8:1 or Higher)

This is the counterintuitive one. An extremely high ratio isn't always good news. While it signals incredible efficiency, it often means you are underinvesting in growth and leaving market share on the table for your competitors to scoop up.

- Diagnosis: Your marketing is incredibly effective, but you're being too conservative with your budget. You have a proven, repeatable model that can handle way more volume.

- Actionable Insight: It's time to get aggressive. Reinvest profits heavily into your proven acquisition channels. If your SEO efforts are bringing in customers with a 10:1 ratio, it's time to double your content budget and hire an SEO specialist to scale that advantage before your competitors catch on.

Knowing your LTV to CAC ratio is like getting a diagnosis from the doctor; improving it is the treatment plan that builds a truly healthy, resilient business. Optimizing this metric isn't about finding a single silver bullet. It's a two-front war: you have to systematically lower what it costs to land a new customer while, at the same time, increasing how much value you get from them.

This isn't just a task for the marketing team. A great ratio is the sign of a well-oiled machine where your product, marketing, and engineering teams are all pulling in the same direction toward sustainable growth. Let’s get into the practical, actionable tactics you can use on both sides of this critical equation.

Driving Down Customer Acquisition Cost

Lowering your CAC is all about efficiency and relentless focus. It means plugging the leaks in your marketing funnel, doubling down on the channels that actually work, and having the discipline to cut the ones that just burn cash. The goal isn't to spend less—it's to spend smarter.

Here are a few high-impact strategies to reduce what you spend for each new customer.

- Refine Your Ad Channel Mix: Not all acquisition channels are created equal. Some will deliver high-value customers for pennies on the dollar, while others bleed your budget dry with little to show for it. You have to be analyzing this constantly. A monthly audit of your paid channels is a great place to start. Go beyond simple conversion counts and look at the LTV of customers from each source. If you find customers from LinkedIn ads have a 2x higher LTV than those from Instagram, it’s time to reallocate your budget, even if the initial cost-per-lead is a bit higher.

- Optimize Your Conversion Funnel: Your website and app are your most important sales reps. Every bit of friction—a slow-loading page, a confusing checkout, an unclear call-to-action—is costing you customers and quietly driving up your CAC. Using a tool like Hotjar or FullStory to watch real user sessions can be eye-opening. You might discover that 70% of users abandon their cart on the shipping page. Fixing one buggy form field could drastically improve your conversion rate and lower your CAC without spending another dime on ads.

- Leverage Organic and Referral Growth: Organic channels like SEO and word-of-mouth referrals bring in your most profitable customers, hands down. They’re built on trust and value, which means the marginal cost for each new user is close to zero. A simple referral program can turn your entire user base into a low-cost acquisition engine. Dropbox famously grew 3900% in 15 months by offering free storage for referrals. For more on this, check out our complete guide to user acquisition for mobile apps.

Boosting Customer Lifetime Value

While cutting CAC is important, increasing LTV is where you find exponential growth. Small tweaks in retention have a massively outsized impact compared to small tweaks in acquisition. Seminal research showed a tiny 5% increase in retention can drive 25-95% more profit—a finding that has held true for over two decades.

The math is simple: it costs 5 to 25 times more to acquire a new customer than to keep an existing one. That’s why the smartest founders are obsessed with nurturing the user base they already have.

Here are the key levers for making every customer more valuable.

- Enhance Retention and Crush Churn: Every customer you lose is a direct hit to your LTV. The single most powerful way to boost LTV is to keep your customers happy, engaged, and subscribed for as long as possible. Often, the silent killer of retention is just a bad product experience.

A slow, buggy, or unreliable application is a churn factory. No marketing campaign can save a product that users find frustrating to use. Investing in technical health and stability is a direct investment in your LTV.

Start by monitoring your application's performance and error rates. If your app crashes for 5% of users during onboarding, you're lighting money on fire. Prioritizing bug fixes isn't a cost center; it's a core retention strategy.

- Implement Smart Upsell and Cross-sell Strategies: Your existing customers already know and trust you, making them the perfect audience for additional products or premium features. The trick is to offer value that perfectly aligns with what they're trying to do right now. For a SaaS tool, this could mean triggering an upsell offer the moment a user hits a usage limit. For example, when they try to add a fourth team member to a "Starter" plan limited to three, prompt them to upgrade to "Pro." A contextual offer like this will always outperform a generic email blast.

- Optimize Your Pricing and Monetization Model: Pricing is not a "set it and forget it" task. It has to evolve with your product and the market. So many companies leave huge amounts of money on the table by underpricing their services or failing to connect price to value. A quick win here is moving from a single flat rate to a tiered, value-based model. Segment your features into packages (e.g., Basic, Pro, Enterprise) that map to different customer personas. This lets you capture more revenue from power users while keeping an accessible entry point for smaller customers.

Actionable Levers for LTV CAC Optimization

To bring it all together, improving your LTV:CAC ratio is about pulling specific, strategic levers. Some tactics lower your costs, others increase value, and the best ones do both.

The table below breaks down the goals, strategies, and practical examples you can start implementing today.

| Goal | Strategy | Actionable Tactic Example | Impact on Ratio |

|---|---|---|---|

| **Decrease CAC** | **Channel Optimization** | Audit paid channels monthly. Reallocate spend from low-LTV sources (e.g., Instagram ads) to high-LTV sources (e.g., LinkedIn ads). | Lowers cost to acquire high-value users. |

| **Decrease CAC** | **Conversion Rate Optimization** | Use session recording tools (like Hotjar) to find and fix a checkout page bug that causes 70% of users to drop off. | Converts more paid traffic, lowering effective CAC. |

| **Decrease CAC** | **Organic Growth** | Launch a referral program that gives existing users a free month for every new customer they bring in. | Acquires new customers for near-zero marginal cost. |

| **Increase LTV** | **Retention Improvement** | Prioritize fixing a bug that causes the app to crash for 5% of new users during onboarding. | Plugs a major churn point, extending average customer lifetime. |

| **Increase LTV** | **Expansion Revenue** | Implement contextual upsell prompts when users hit plan limits (e.g., adding a 4th user to a 3-user plan). | Increases ARPU by moving users to higher-value tiers. |

| **Increase LTV** | **Pricing & Monetization** | Shift from a single price to tiered, value-based plans (Basic, Pro, Enterprise) to better capture value from different segments. | Increases ARPU without alienating entry-level customers. |

By systematically applying these levers, you move from simply measuring your metrics to actively controlling them. This methodical approach is the foundation of every truly sustainable, high-growth business.

How Technical Health Secretly Kills Your Metrics

The link between your app's code and its financial performance is direct and unforgiving. Founders are usually laser-focused on marketing funnels and pricing, but the silent killer of a healthy LTV:CAC ratio is often hiding in plain sight: poor technical health. Technical debt, sluggish performance, and a buggy user experience aren't just headaches for your engineers—they actively destroy customer value and inflate your acquisition costs.

Think about it. A fragile or poorly built application creates friction everywhere. When a user hits a bug during onboarding, waits for a slow-loading dashboard, or experiences a random crash, their trust evaporates. This frustration is a direct driver of customer churn, which absolutely craters your LTV. It doesn't matter how great your product vision is if the app itself feels broken.

But the damage doesn't stop there. A buggy app also quietly inflates your customer acquisition cost by tarnishing your brand's reputation and creating a ton of operational drag.

The Hidden Costs of a Fragile Product

A product riddled with technical problems forces your team into a constant state of reaction. It's a negative feedback loop that hammers both your LTV and CAC at the same time, with consequences that ripple through the whole business.

- Bloated Support Costs: Every bug report and performance complaint creates a support ticket. This swamps your customer support team, adding direct salary and software costs that should absolutely be factored into your CAC.

- A Ruined Reputation: Unhappy users don't just churn; they talk. Bad reviews in the app stores and negative comments on social media are basically anti-marketing. They poison the well for new prospects, making every single acquisition more difficult and expensive.

- Paralyzed Feature Development: When your engineering team is forced to spend 30-40% of their time putting out fires and patching bugs, they aren't building the new, value-adding features that increase LTV and justify higher prices. The opportunity cost here is massive.

Technical debt is a tax on every future feature you want to build. A stable, well-architected codebase isn't just about preventing problems; it's about creating the velocity needed to innovate and win.

How a Solid Product Drives Profitability

On the flip side, investing in technical excellence is a direct investment in your unit economics. A robust, scalable, and reliable application is the bedrock of a healthy business. It creates a positive cycle that strengthens your LTV to CAC ratio from both ends.

A high-performing product is the single most effective retention strategy. Period. When an app is fast, intuitive, and just plain works, customers are far more likely to integrate it into their daily lives, upgrade to premium tiers, and tell their friends about it. This directly boosts LTV through longer customer lifetimes and higher average revenue.

Real-World Example: A B2B SaaS Tool

Imagine a project management tool that frequently freezes when users try to export reports. It’s frustrating, support tickets are piling up, and churn among power users—the most valuable customers—is a terrifying 8% per month.

The company dedicates one development cycle to re-architecting the export feature. They slash its loading time by 90% and completely eliminate crashes. The results are immediate:

- LTV Impact: Monthly churn for their power users plummets from 8% to 3%. This one fix more than doubles the lifetime value of their best customers.

- CAC Impact: Support tickets related to exports drop to almost zero, freeing up the support team. Even better, positive word-of-mouth starts to spread, driving more organic sign-ups and reducing the company's reliance on expensive paid ads.

This shows how a single, targeted technical improvement can have a massive financial impact, turning a leaky bucket into a sustainable growth engine.

Applying LTV and CAC Insights in the Real World

Knowing the formulas is one thing. Applying them when your cash is burning is another entirely. To really get a feel for the tug-of-war between customer acquisition cost vs lifetime value, let's walk through a real-world scenario where a startup’s growth hit a wall, even with a product people should have loved.

Meet "ConnectSphere," a subscription-based social scheduling app. On paper, things looked okay—they were pouring money into ad campaigns and getting a steady stream of new sign-ups. But their LTV to CAC ratio was a painful 1.2:1. They were basically spending a dollar to make a dollar and twenty cents. The business was treading water, burning cash with every new user.

The problem was obvious: sky-high customer churn. But the reason for it wasn't. Users loved the idea of the features, but the app itself was slow, buggy, and just plain unreliable. This fragile codebase was the silent killer of their LTV.

A Turnaround Rooted in Technical Health

Staring down the barrel of a crisis, ConnectSphere brought in a technical growth firm to figure out what was really going on under the hood. The first move wasn't a marketing brainstorm; it was a deep codebase audit. It didn't take long to find major performance bottlenecks and architectural flaws that made the application crumble under any real user load.

Instead of just patching the leaks, the focus shifted to reinforcing the app's foundation. The game plan was simple and direct:

- Identify High-Risk Areas: Pinpoint the exact parts of the codebase causing the most crashes and slowdowns.

- Execute a Hardening Plan: Refactor the brittle code, optimize database queries, and slash server response times.

- Measure Business Outcomes: Tie every single technical fix directly to business metrics like churn, session length, and engagement.

The goal wasn't just to write cleaner code; it was to build a product experience that made customers want to stay. This is how you align development incentives with the LTV to CAC ratio.

The results weren't just theoretical. They were immediate and transformative.

From Surviving to Thriving

Within three months of stabilizing the platform, ConnectSphere’s metrics did a complete 180. The single most important change was a 40% reduction in monthly customer churn. That one fix had a massive, compounding effect on their LTV.

But that wasn't all. With a faster, more reliable app, user session length jumped by 75%. People were finally sticking around. With this newfound stability, the team confidently rolled out a new premium feature set, and a huge chunk of their newly retained users happily upgraded.

This turnaround story holds a critical lesson for any app founder. Fixing your unit economics isn't always about tweaking ad spend or running a new pricing experiment. Sometimes, the most powerful lever you can pull is investing in the technical health of your product. You can learn more about how to reduce customer churn by shoring up these foundational issues.

Common Questions About LTV and CAC

Even after you've got a handle on the relationship between customer acquisition cost vs lifetime value, the real-world questions start popping up. We get these all the time from founders and product leaders trying to turn these metrics into action.

Here are some of the most common ones we see.

How Often Should I Calculate My LTV to CAC Ratio?

If you're an early-stage startup, you should be looking at this monthly. At a bare minimum, quarterly. Things move too fast in the beginning to wait any longer. A new marketing campaign, a pricing change, or a product update can swing your numbers wildly, and you need to spot those trends before they burn through your cash.

Once your business matures and the data smooths out, a quarterly or even semi-annual check-in can work. The key isn't a magic number—it's consistency. Regular tracking is the only early warning system you have for the health of your business model.

What Are the Biggest Mistakes Startups Make When Calculating These Metrics?

With CAC, the number one mistake is not "fully loading" the cost. Founders love to just count the ad spend. They conveniently forget the salaries of their marketing and sales teams, the cost of their analytics tools, and the money spent on creative. This makes the numbers look great, but it's a fantasy.

For LTV, the classic error is forgetting about gross margin. Another huge one is failing to segment customers. Lumping all your users together into a single LTV number is dangerously misleading. Your power users are not the same as your low-engagement cohorts, and you need to know the difference.

Averages hide the truth. Your most profitable customer segment might have an LTV of $2,000 while a less-than-ideal group is sitting at $200. Knowing this is everything—it tells you exactly where to point your acquisition firehose.

My LTV to CAC Ratio Is Below 3 to 1. What Should I Do First?

If your ratio is under the 3:1 benchmark, stop everything and focus on retention. Don't even think about optimizing ad spend yet. Fixing retention almost always delivers a bigger, faster impact on your bottom line than trying to shave a few cents off your CAC.

Your first job is to figure out why people are leaving.

- Dig into the data: Look for the patterns. Is there a point in the user journey where they drop off? A specific feature they ignore?

- Talk to your users: Don't guess. Send exit surveys. Get on the phone. Find out in their own words why they churned.

- Check your technical health: Bugs, downtime, and slow performance are silent killers. Stabilizing the product is often the lowest-hanging fruit and can give you a quick, meaningful LTV boost.

While you're doing that, audit your acquisition channels. Hit pause on the ones that are bleeding the most cash. Stop the bleeding first, then fix the underlying problem.

At Vermillion, we partner with founders to build high-performing, scalable applications that directly move the needle on retention and LTV. If you need a technical partner to shore up your product and drive sustainable growth, let's connect.